Here Are The 5 Worst States To Flip A House In

Flipping houses has gotten a lot of attention over the last few years. With a housing market in ascendency and buyers seemingly engaged in a bidding war over virtually every property on the market recently (via The Wall Street Journal), many people are interested in trying their hand at real estate investing.

This approach to the commodity market comes in two primary flavors: Buyers can purchase a home and then rent it out to develop long-term dividend profits, or they can target undervalued properties and attempt to resell them for a profit as quickly as possible. This second practice is known as house flipping, and it's become a mainstay in the U.S. residential sales marketplace.

While the profits are real and the opportunity remains ripe for those with a keen eye for homes listed for great bargains, not all markets are created equal, and not all buyers are prepared for the immense pressure to perform that comes along with the task of actually pulling off a house flipping sale.

One feature of the market that is unavoidable is geography. While you can purchase a rare baseball card or antique coin in New York and resell it in California days, months, or years later, this isn't possible with residential assets. With this reality in mind, flippers might want to steer clear of these five states that have historically been unkind to purchasers looking to make a quick profit on their investment.

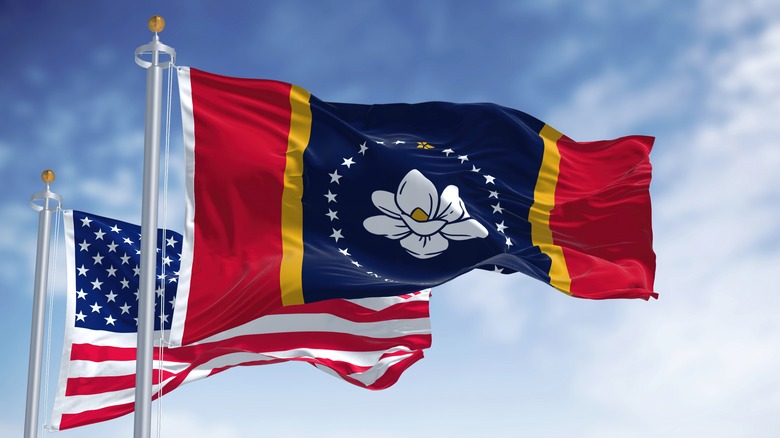

1. Mississippi

Mississippi boasts an abysmal 4.3% average return on investment (ROI) for flippers, according to CNBC. The dire state of the marketplace should turn off any savvy investor looking to set out for new opportunities in their local area or beyond it. In contrast, CNBC also reports that Tennessee and Pennsylvania (its two best rates states for flippers) present an average ROI of 132.7% and 162.4%, respectively.

One area that dominates the flipper market is this ROI figure. An investment simply isn't worth the time, effort, and financial risk if it doesn't provide a sizeable potential payout at the end of the holding period. Of course, all investments come with the risk of losing some or all of the value pushed into the asset — although a total loss is astoundingly rare in most investment scenarios across commodity markets. But a margin as low as Mississippi's should give pause to anyone considering jumping into the real estate space.

There just isn't enough there to justify all but the most niche uses of property flipping in this southern state.

2. Hawaii

Hawaii might be the perfect location to purchase a holiday home, but as a flipper, you might want to shy away from the island community. Real Hawaii notes that both cost of living figures and price per square foot on real estate across each of the state's islands are astronomical compared to communities found on the mainland.

This means that a buyer will need to commit to living in this inflated cost environment through the purchasing, improvement, and sales phases, which will require a far heftier upfront investment to make the purchase.

When you add in the insular nature of this island that's located almost 5,000 miles away from the bulk of the United States and has a population just shy of 1.5 million (via World Population Review), the potential to attract new buyers is much slimmer than elsewhere in the nation.

Buying and flipping a property here in an effort to create profit is a much riskier endeavor than in most other locations in the U.S. and is likely a hasty move for anyone who isn't highly experienced with the community, geography, and routines of the state.

3. Montana

The Montana property market doesn't fare much better than Mississippi's, coming in at third on CNBC's list. With the state's intense geographical remoteness, smaller population than Hawaii's already minuscule figure, and flagging return on investment average that hovers just below 13% (via CNBC), Montana offers investors a difficult marketplace to flip homes in. One thing that all great flipper's markets appear to have in common is the abundance of dense urban and suburban areas; this is something that Montana starkly lacks.

Without a vibrant real estate marketplace and buyers who are looking to move around metropolitan areas to facilitate lifestyle needs tied to the cities themselves, Big Sky country offers a lot in the way of relaxation, openness, outdoor exploration, and more, but the property market simply isn't a hot one that investors can tap into for generous profits.

Looking elsewhere is your best bet when searching for a great opportunity to quickly and successfully flip homes as a side gig or as a primary source of investment-driven income.

4. Wyoming

Even as Montana's population and general lack of urban sprawl stood out, Wyoming's extremes in this regard eclipse it by an enormous margin. Nations Online reports that Wyoming is the smallest state in the United States by population (with about 579,000 people — less than even the non-state jurisdiction of Washington D.C.).

This makes the market just as sparse as some of those in neighboring states. Montana, Wyoming, and others in the vicinity offer some of the most awe-inspiring vistas in the country, but when it comes to ease of access, travel to these remote segments of the United States can be very difficult, and amenities potentially hard to come by as a result of the thin population figures this far northwest.

It's perhaps for these reasons that Wyoming sports such a long average time to flip, according to CNBC. In some of the most favorable locations, the outlet notes that the average time from purchase to resale is 180 days, while the worst exhibit a timeline of roughly 203. Wyoming's average is far higher, at 231 days, or an extra month over the average of the state's ilk in this financial endeavor.

Selling fast is always the goal, but with the added average month of property ownership, a flipper will be on the hook for an additional month of mortgage payments, tax assessments, and other costs to maintain the property while searching for a buyer.

5. South Dakota

South Dakota's data points resemble the other states on this list in a clear fashion, but one thing stands out above all others. South Dakota's average return is a decently respectable 26.1%, yet the take stands at just $17,750 (via CNBC).

Both of these figures are important when considering an investment because a great profit margin is always desired. However, the actual dollar amount returned can signal a great opportunity or a difficult road ahead.

Penny stocks, for instance, offer investors a one-of-a-kind opportunity to make a killing — if the share price expands. A stock bought for a dollar only needs to inflate in price by 20 cents to make a 20% profit and double the annualized return that stock investors can expect with an index-driven portfolio (via Nerd Wallet). But the risk factor attached to a penny stock is much greater than that of a portfolio marked by blue chip company shares, index funds, and other mainstream assets. The shares might go up by this slim margin and earn you a healthy increase, but to enjoy the value of that 20%, you'll need to invest a huge volume of equity that could just as easily collapse.

South Dakota's average return feels a lot like the speculative value provided by penny stocks: If things go your way, a healthy percentage is expected, but to see a relatively valuable net increase, you'd need to invest in quite a few properties and continue to enjoy luck on your side.