Why New NYC Real Estate Listings Are Down By More Than 8,000 Since 2018

It is harder to predict the housing market now than ever before. Since 2020, real estate was thrown for a loop as the ongoing uncertainty around the COVID-19 pandemic affected people's livelihood, which would eventually trickle down to many of those reevaluating their housing situations. Additionally, social distancing and stay-at-home orders had homeowners and renters alike all pining for more space, according to CNBC.

Although people seemed reluctant to look at new properties or even consider moving at the beginning of the pandemic, by the summer there was a noticeable boom in product availability. This increase in listings paired with lower mortgage rates had buyers racing to open houses.

After the frenzy of a busy real estate market that had the worth of the average home in the United States jump to 32.4% more than two years prior, per Zillow, it seems that the buzz on buying new digs is slowing down. But what is the driving force that is pressing the brakes? Especially in the hot New York City market that had record sales of apartments and housing during the 2021 season, as noted by The New York Times, it seems that the listings available in 2022 have dropped significantly. Let's look at what's affecting the dwindling numbers and see what those hoping to find real estate in the Big Apple can look forward to.

Several factors are at play

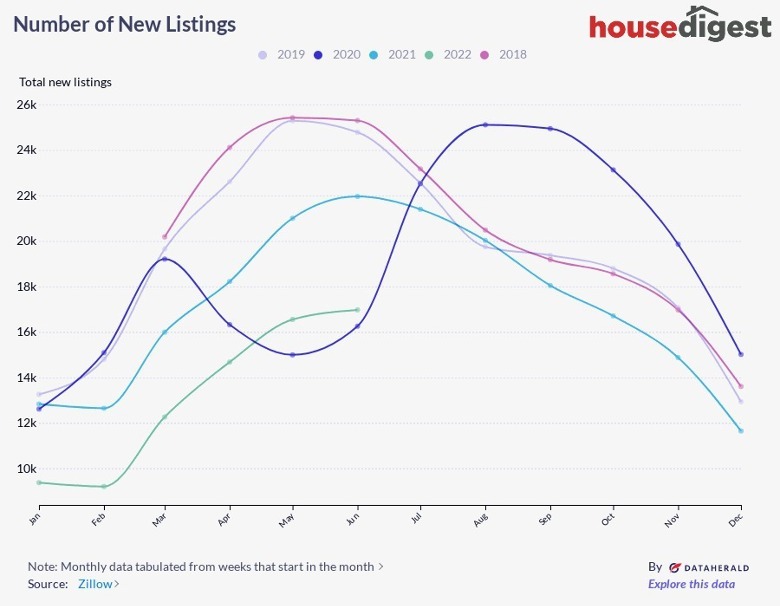

Data collected by Zillow about the number of new listings in New York City over the last four years shows that as of June 2022 there was a significant decrease in available listings. When compared to June in previous years — when the catalog of new availabilities reached 24,777 in 2019 and 21,953 in 2021 — 2022 sunk to a low of 16,967 listings, which is a far cry from the 25,291 that were obtainable in 2018. So why are there so few listings on the NYC market now?

It seems that there are a number of factors in play that would explain the decrease. According to The New York Times, the cost of borrowing money is at an all-time high, with mortgage rates rising upwards of 6%. This means that if you rely on a mortgage to purchase your home, then there will be a dramatic increase in your monthly interest payments. This could be the deciding factor as to why there are not as many people both willing to buy a new home or put their current residence up for sale in a cooling market. According to the Fannie Mae National Housing Survey, the desire to purchase a new property for homebuyers has dropped by 21%. This attitude change is largely due to higher house prices and interest rates, as well as the competition for the already lean inventory.