What Happens If You Don't Pay Your Property Taxes?

Life is expensive enough, and then you end up with a big property tax bill to pay. Property taxes, where applicable, are a required tax payment made to the county in which you live. These taxes help to fund government services, including roads, parks, libraries, and others.

In most areas, the amount of property taxes paid is dependent on the assessed value of a home. The assessed value is typically based on the decisions made by the city or county tax assessor. In some cases, local tax offices base this off the appraised value, the market value, or a combination of the two, according to Rocket Mortgage.

Though not all states have property tax laws, in those that do, it is critical to ensure you pay them by the date provided. Failure to do so could lead to some significant financial losses.

What could happen to your home if you don't pay your property taxes?

Putting your home at risk

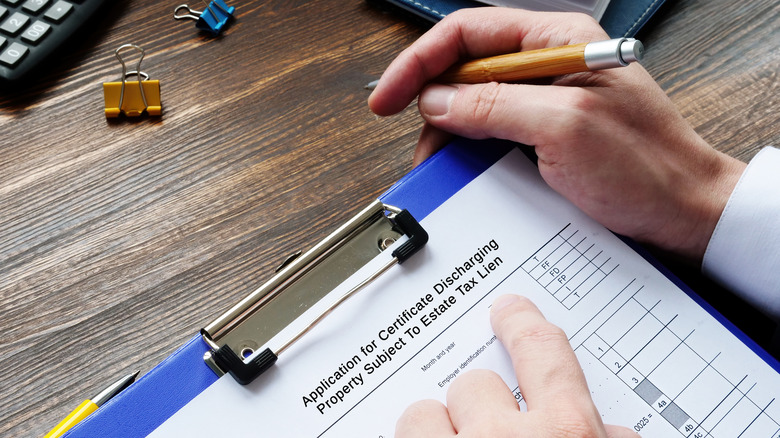

What happens if you don't pay your property taxes is ultimately defined by your state's specific laws. However, it is not uncommon for property owners to lose their homes. The county may force the sale of the home, place a tax lien on the home, or force a tax foreclosure.

For example, if you fail to pay property taxes in Ohio, Nolo states that you'll get a notice from the taxing authority in the county, and then the property will have a tax lien applied to it. The county can then force the sale of the property requiring the buyer to pay off the taxes owed.

In Illinois, after receiving a warning, a tax sale occurs, in which a tax lien buyer is able to purchase the tax debt you owe. You then have the option of redeeming your taxes by making a payment, or the country clerk allows the tax buyer to provide a tax deed on the property, which makes the tax lien buyer the owner of the property. At that point, they can evict you from your home, according to Illinois Legal Aid Online.

What to do now

If you are behind on property taxes, one of the first steps is to contact the taxing authority to inquire about any available programs that could help you to get back on track. Nolo states that there are abatement, deferral, and repayment programs available through many counties and states for which you could qualify, depending on your situation.

For example, seniors and veterans may be able to request a reduction in their property taxes. If that is not possible, you may qualify for a deferral, which allows you to postpone making the payment if you meet specific conditions set by the taxing authority.

You may also wish to turn to your taxing authority to determine if you can make payments to get caught up on what you owe. Your mortgage lender may also be able to help by setting up an escrow account funded through an added cost on your mortgage payment. When you do, the lender pays your property taxes directly for you.