The Biggest Scams To Watch For With Solar Panel Installers

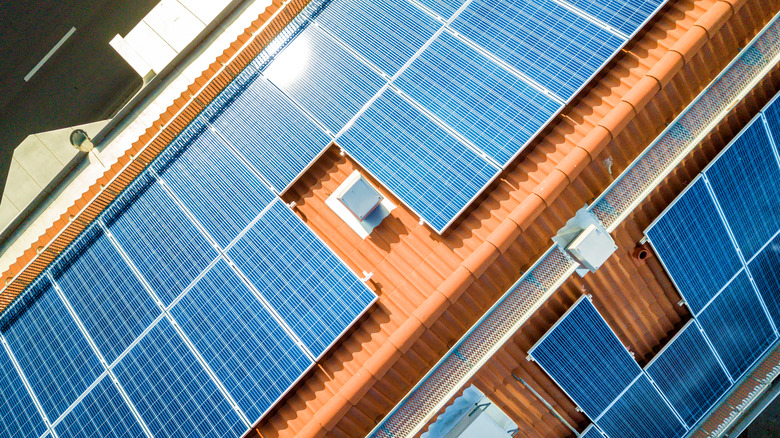

Solar panel installations have seen a major uptick in recent years, largely due to some appealing selling points and a growing need to cut down on energy use. As a homeowner, who wouldn't want to receive a tax credit for helping out the environment, and for lowering your energy bill?

But as attractive as some of the pros are, solar panels are a costly investment, ranging from $10,000 all the way up to $40,000 — and that's for an all-cash purchase, reports U.S. News & World Report. At such a steep price, it's crucial to do your due diligence and research before making the switch to solar. Scam artists have taken note of how quickly the solar panel market has grown, and they've come up with some clever ways to entice, confuse, and outright manipulate even the most seasoned homeowners. So put down your pen — before you go signing any sort of solar contract, we've rounded up some of the most common tactics that solar panel installers use to turn your well-intentioned investment into the product of yet another scam.

Be wary of government representatives

As with most scams, the first place to start is by doing a little digging about the person pitching the product. If the salesperson seems aggressive or exceedingly pushy, then chances are they're representing a questionable product — you should ask to speak with another representative, and if you receive the same treatment, it's likely a solar panel sham.

Another red flag? If the solar panel company is reportedly a government representative, or any sort of authority figure representing a utility service, that's something to be wary of. Solarponics explains that a common tactic among solar panel scam artists is to cold call homeowners pretending to be a government employee looking to offer a free energy audit. It's easy to fall for this act and trust an authority figure, but once they get to your home, they'll start pushing the product (and likely at a cost far greater than the value at play). If you receive a call from someone claiming to be a representative, take your time and do the proper research before inviting the company to your home or signing any sort of deal.

Verify any offered solar panel tax credits

One of the biggest pros of springing for a solar panel installation is the tax credits, and that's no scam. For solar panels installed between 2020 and 2022, the federal Investment Tax Credit sits at a very attractive 26% — that means that eligible homeowners can receive a reduction on their income tax because of their purchase (via Energy.gov).

This tax credit, however, also set the foundation for a very believable scam opportunity. Solarponics warns that many of these shady companies name drop tax credits to get the interest of buyers, and toss around some legal and tax-related jargon to confuse people before purchasing. They might promise rebates or credits that simply don't exist in your state, or exist at all.

Matthew R. Osborne, a consumer law firm based out of Colorado, elaborates on another potential "bait-and-switch" technique that is becoming popular among these sham companies. This is when solar panel installers imply that homeowners will receive hefty rebates or tax credits, but then provide them with leased panels — but since they're technically not owned, it makes them ineligible.

Never lease your solar panels

Missing out on the federal tax credit is a real hit to homeowners hoping to take advantage of the perks of solar panels, but unfortunately, leasing comes with a whole slew of other negatives. Unbound Solar notes that you usually will only be in possession of the panels for about 15 years, and then have to return or purchase them — leading you to spend more money in the long run. They report that over 25 years, leased panels will return between $5,000 and $10,000 in energy savings, whereas financed panels will earn you just under $30,000. You may save on your energy bill month to month, but since you'll never fully own the system, you'll be bamboozled out of your budget in no time.

Leased solar panels have also led to a worrisome trend in the housing market, reports The Washington Post. First, they're not included in the appraisal of a home, which can be a major punch to any homeowner looking to make back the money they've invested. Even worse? Any potential buyers have to qualify for the same terms of the lease — and if they can't make the credit cut, your sale may fall through.

Keep an eye out for shady contracts

Contracts are key to a successful solar panel install — it's crucial to make sure you have something in place and signed before any work begins to avoid any last minute switch-ups on the product or the cost, explains Solarponics. Sometimes, companies will offer low prices and incredible deals to entice customers, and by the time the contract hits the table, the prices have inflated considerably. Or — even worse — the contract is signed and the bargain is locked in place, but the panel installation may not pass inspection because the company cheaped out on materials to meet their offer.

That being said, the wrong contract can also lead to a sticky situation that may require legal and financial assistance to get out of. Consumer law firm Matthew R. Osborne particularly warns against a common contract scam known as Power Purchase Agreements, or PPAs. These contracts are at least 10 years long, and lock the consumer into a contract in exchange for "free" solar equipment. And yet, if the homeowner wants to get out of the contract for whatever reason, they'll have a major surprise in the form of a substantial termination fee.

Do your research before you replace existing solar panels

"If it's free, it's for me" — we've all thought it at some point or another. The allure of the word "free" is the root of most solar panel scams, however, and we have some unfortunate news that you've probably heard once or twice before: If you're offered something at no upfront cost, it's likely too good to be true.

According to SunState Solar, many fraudulent solar companies will go door-to-door offering to replace existing panels. They may not know the conditions of your current contract, or whether you own the panels outright at all — they simply want to replace them at no cost. The catch? The replacement panels are usually damaged or made of cheaper material. So even if you've already sealed the deal with a great, reputable company, your purchase isn't necessarily safe from scammers — always keep an eye out for fraud that's intended to take advantage of existing customers.