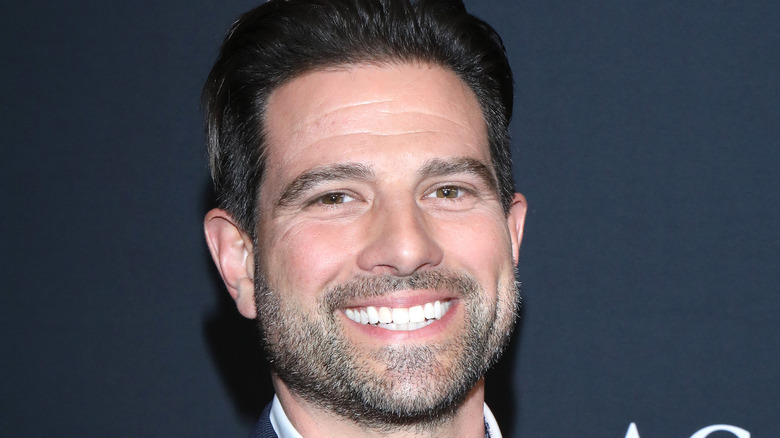

HGTV's Scott McGillivray Explains The Number One Rule For Paying Your Rental Home Expenses

Before buying a rental property, the most important thing to consider is if you can afford all the expenses and still make a profit. Luckily, Scott McGillivray of HGTV's "Vacation House Rules" has a simple way to ensure that this is the case. "The rule that I always say is one week's worth of rentals should be able to generate enough money to support one month's worth of expenses," he tells Realtor.com. To provide an example, McGillivray says, "If you can rent for $5,000 a week and the running expenses on the property are $3,500 a month then obviously, it makes sense," per HGTV.

To do this practically, the first step is to add up all the rental properties' monthly expenses. This will include things like the mortgage, taxes, utilities, cleaning fees, and any costs for renovations. Another big thing to consider is insurance, which may be higher in certain areas because of weather risks like flooding or hurricanes. Then, make sure that your weekly rate is more than this total amount. This is crucial because it will guarantee that you can afford the rental property while also making a profit.

12 weeks equals 12 months of expenses

To clarify why this rule works, Scott McGillivray says, "So if you had a place and you rented it [out] for 12 weeks of the summer, that should pay for 12 months of expenses," per Realtor.com. He gives this example because, for most rentals on beaches or in tropical areas, the peak season will last about 12 weeks. This is when you will make the most money because you'll most likely book all the weeks at your highest rate since there's a higher demand.

Then, if you end up booking your property for more than 12 weeks, that money will be pure profit. "There is enough rental income to cover all my expenses and still put a good profit in my pocket," McGillivray tells HGTV. "Anything outside of those 12 weeks is bonus." Therefore, even if you're not making as much money during the off-season, perhaps because you have to lower your rates or because insurance is higher, all of that money will go straight into your bank account instead of going towards expenses.