5 Myths About Renting You Should Stop Believing

Financially speaking, housing accounts for the largest chunk of most people's expenses — 33.8% in 2021, according to the Bureau of Labor Statistics. With stakes that high it is crucial to make decisions based on the best information available, refusing to allow assumptions or hearsay to lead you astray.

With 30-year fixed mortgage rates breaching their highest levels since 2008, existing home sales have fallen each month from February to September, according to NPR. It seems like people are going back to renting, so experts expect rent to continue rising across the country.

While many people feel they may have missed the boat for cheap mortgages, plenty of households are entering the rental market, speeding up market growth and further upping rental prices for everyone (via Realtor.com). These hikes come at a time when renters are under pressure like never before — per Avail, 47% of renters have missed at least one payment since the beginning of 2020.

So, whether you have been renting for years, or are one of the new households entering or re-entering the rental market, here are five myths to clean out of your brain so you can focus on the real issues at hand.

You're more likely to lose your security deposit if you're a long-term tenant

It's standard practice to pay a security deposit when signing a property lease. This lump sum acts as financial protection for the landlord in case the tenant incurs unforeseen costs. Per Rent, the money is usually kept in a separate bank account until the end of the lease. When the lease is terminated for whatever reason, the landlord makes deductions from the security deposit to cover their costs and pays the remainder back to the tenant.

Confusion occurs around security deposits and long-term tenancies because of the changing nature of who is supposed to pay for what as time goes by. Certain reasons a landlord might take money from a security deposit aren't affected by the length of a lease — if you owe any rent they will simply take it out of the deposit, whether you've been there 2 months or 20 years. Other areas rely on a certain level of interpretation, which changes over time.

According to NOLO, landlords cannot use any security deposit money to cover costs incurred over the course of normal wear and tear. This actually means you've got more of a chance to get your security deposit back as a long-term tenant. Damages that you would be responsible for paying for if they happened in one go — such as carpet stains or appliances that aren't in full working order — are more attributable to wear and tear as time goes on.

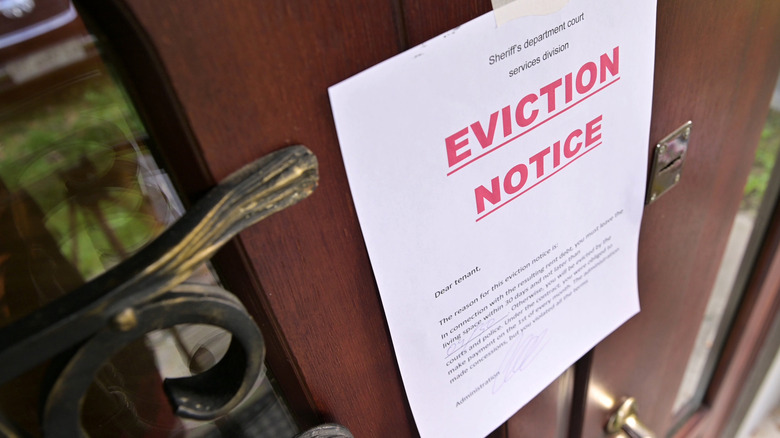

Landlords can evict tenants at the drop of a hat

Though the federal eviction moratorium ended back in August 2021, eight states will have temporary eviction protection measures into 2023, according to the Consumer Finance Protection Bureau. As these protections gradually end, often with well-publicized court cases that make it seem like all landlords can't wait to evict people, it can feel like your risk of eviction has suddenly increased dramatically. However, tenants still have significant legal protection from eviction.

As Justia explained, landlords can't just switch out the locks, throw your possessions on the street, and put the place back on the market. There is a formal process for evictions and it must be followed properly by the landlord or they risk fines, and potentially not being able to evict the tenant at all.

According to Cornell Law School, there are three reasons legally to evict tenants — the lease has ended, the tenant isn't paying rent, or they've broken the lease agreement in some other non-trivial way. If you pay your rent, still have a valid lease, and keep to those terms, you shouldn't need to worry about being evicted. Even if you are going to be evicted, your landlord is required to give you notice. The timing of this varies by jurisdiction, but it should at least give you time to make sure you understand your rights and speak to a lawyer.

All repairs and upkeep are the landlord's responsibility

One of the most appealing parts of renting is avoiding the time, money, and labor costs incurred by all the annoying maintenance jobs that homeowners have to deal with, explains MyMove. However, just because the burden of ownership doesn't fall directly on you as a tenant, this doesn't mean you're off the hook for all of the home upkeep costs.

As Military by Owner points out, there is significant state-by-state fluctuation in where exactly the limits of a landlord's responsibility lie, and which tasks tend to become the tenant's to handle. In most cases, the landlord is responsible for wear and tear and ensuring the house is habitable. This means a structurally sound home with working utilities such as water, power, and heat, and no health hazards — i.e. infestation, faulty wiring, or other environmental risk factors. As a tenant, you are responsible for repairing any damage caused by yourself, your guests, or your pets, as well as minor inconveniences such as blown lightbulbs.

In the gap between these two lists of responsibilities, confusion can occur. The best way to stop that confusion from becoming costly is to make sure there's a good line of communication between tenant and landlord. According to Apartments.com, tenants will have to pay for repairs incurred by their own bad communication. It is often cheaper to let your landlord know about a minor issue quickly than let it worsen over time until it requires an expensive fix.

Bad credit makes renting an apartment impossible

The most important thing to landlords is making sure that they get their rent paid in full and on time. Given the high level of competition in the rental market at the moment, it is likely that potential landlords will run a credit check on you and other potential tenants. According to American Express, landlords use credit scores to help determine which tenant will be the most reliable and therefore the most desirable. However, approximately 30% of Americans have a credit score below 670.

The good news is that there are several ways to rent an apartment with a bad credit score. According to Bankrate, the quickest fix is to shift your search toward landlords and real-estate companies that aren't going to reject you out of hand. Typically this means private landlords rather than management companies, as they are empowered to make case-by-case decisions, rather than needing to complete a checklist.

The other crucial step is to find ways to prove to a landlord that you are financially trustworthy. Per PropertyClub these could include letters of recommendation, bank statements, or finding a co-signer — anything that can give the landlord peace of mind. Though it's not recommended, if nothing else works, money talks, so don't forget that you can offer to pay a higher security deposit or a premium on rent to soothe any remaining qualms on the part of your landlord.

Landlords have the right to entry whenever they want

Landlords often have responsibilities that require accessing the property for repairs and inspections. However, tenants have a right to privacy while they quietly enjoy their homes. A landlord showing up without notice, without permission, or otherwise harassing the tenant could technically be trespassing and at risk from criminal proceedings, according to Rent Prep.

The majority of states have laws that govern how and when your landlord is allowed to enter your home. If they think you have abandoned the property, or there is an emergency such as a fire or leak, landlords are usually allowed to enter, per Investopedia. Otherwise, they are supposed to provide you with adequate advance notice that they plan to enter your home. Some states stipulate a time period like 24 or 48 hours, while others just require that the notice period be reasonable, and a small minority have no legal restrictions on landlords visiting at all, according to PrivacyRights.org.

If you are unsure about the situation with your landlord and their entry rights, first check your lease agreement for any clauses stating landlord entry procedures — some states allow these agreements to take precedence over statutory law. If you are still unclear about the situation, NOLO created a state-by-state breakdown of landlord access laws for reference. They also recommended taking any further questions to local tenant's rights groups who will have a detailed understanding of local regulations.