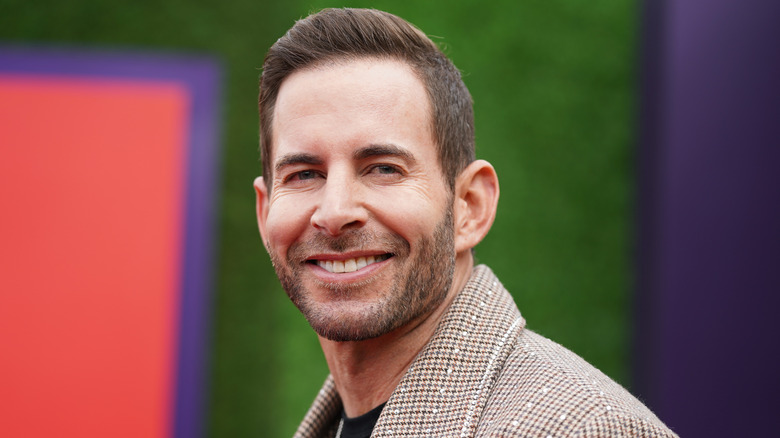

The One Thing HGTV's Tarek El Moussa Wants Homebuyers To Do Before Touring Homes

If you're in the market for a new home, you might be thinking a lot about the home style you want and how you're going to decorate it to suit your needs and your tastes. It's fun to tour homes and visualize yourself in them even when it's still early on in the process, but Tarek El Moussa advises against this. The valuable real estate tip this HGTV star has for homebuyers is to get approved for the mortgage first. "If you are serious about buying, be serious about the financing, and get pre-approved for your loan," he said to Realtor. By not putting the cart before the horse, you will prevent any surprises and avoid wasting your time.

When buying a home, lenders determine your borrowing power by assessing your income, your debts, and your financial situation overall. It's important to find this out first because it lets you know what options are accessible to you from the jump. When you've sorted this out, you will be efficient and realistic, and you can start your search with confidence.

Get approved for the mortgage first

Some people get pre-qualified and start to make moves like booking home tours, but there's actually a big difference between being pre-qualified and being pre-approved. "Having a pre-qualification letter does not carry as much weight. There's a big difference between what banks say they are willing to lend you and what they actually end up lending," Tarek El Moussa explained. Pre-qualification is based on the information you provide to the lender so if you meet the requirements on paper, you get a general estimate of how much you can borrow. A mortgage pre-approval, however, is a more extensive process.

To get pre-approved, you'll need to fill out a mortgage application (probably with a fee) and get your credit and finances checked. Then you receive a specific number of how much you can borrow. No credit or finance check occurs with a pre-qualification. A seller will naturally prefer a buyer who is pre-approved because it's more concrete, so prioritize this before viewing homes. If you can't wait, however, the quickest way to get pre-approved for a mortgage is to get all your documents ready. Some that are required are bank statements and pay stubs, and, if you have it, proof of a substantial down payment.

Other things to keep in mind

Another thing that's recommended to do before booking home tours and going to viewings is to make a list of your wants and needs. Identifying your absolute must-haves and separating them from things that are just nice to have when looking at properties will keep you focused and anchored in reality. Some must-haves can be a house on a quiet street, a certain school district for your small kids, or a big backyard for your pets. When you have this list, do a lot of research on the neighborhoods before you go and prepare questions for the sellers.

It's also a good idea to start your viewing at the low end of your budget instead of going right to the maximum amount you can spend. This keeps you in a safe place and acts as a buffer in case anything changes with the price down the line. You don't want to end up "house poor", which is when you spend most of your income on your home and can't spend much on anything else. A little preparation before you start touring homes can make the process much more enjoyable.